FD LEGAL

TUITION AND FEES

The governing board of a junior college district may set and collect with respect to a public junior college in the district any amount of tuition, rentals, rates, charges, or fees the board considers necessary for the efficient operation of the college, except that a tuition rate set must satisfy the requirements of Education Code 54.051(n). The governing board may set a different tuition rate for each program, course, or course level offered by the college, including a program, course, or course level to which a provision of Education Code 54.051 applies, as the governing board considers appropriate to reflect course costs or to promote efficiency or another rational purpose. Education Code 130.084(b) To be eligible for and to receive money appropriated under Education Code 130.003(a), a public junior college must, among other requirements, collect, from each full-time and part-time student enrolled, tuition and other fees in the amounts required by law or in the amounts set by the governing board of the junior college district as authorized by Education Code Title 3 and grant, when properly applied for, the scholarships and tuition exemptions provided for in the Education Code. Education Code 130.003(b) | |

Tuition and Fee Exemptions and Waivers | |

Application of Exemptions and Waiver | Notwithstanding any other law, a mandatory or discretionary exemption or waiver from the payment of tuition or other fees under this Education Code Chapter 54, Subchapter D, or another provision of the Education Code applies only to courses for which an institution of higher education receives formula funding. Education Code 54.2002 |

Continuation of Exemption or Waiver | Notwithstanding any other law but subject to Education Code 54.2001(f), after initially qualifying under Education Code Chapter 54, Subchapter D, for a mandatory or discretionary exemption or waiver from the payment of all or part of the tuition or other fees for enrollment during a semester or term at an institution of higher education, a person may continue to receive the exemption or waiver for a subsequent semester or term only if the person: 1. As a graduate or undergraduate student, maintains a grade point average that satisfies the institution's grade point average requirement for making satisfactory academic progress toward a degree or certificate in accordance with the institution's policy regarding eligibility for financial aid; and 2. As an undergraduate student, has not completed as of the beginning of the semester or term a number of semester credit hours that is considered to be excessive under Education Code 54.014, unless permitted to complete those hours by the institution on a showing of good cause. In determining whether a person has completed a number of semester credit hours that is considered to be excessive, semester credit hours completed include transfer credit hours that count toward the person's undergraduate degree or certificate program course requirements but exclude: a. Hours earned exclusively by examination; b. Hours earned for a course for which the person received credit toward the person's high school academic requirements; and c. Hours earned for developmental coursework that an institution of higher education required the person to take under Education Code Chapter 51, Subchapter F-1, [see EI] or under the provisions of former Education Code 51.306 or former Education Code 51.3062. If on the completion of any semester or term a person fails to meet any requirement set out above, for the next semester or term in which the person enrolls, the person may not receive the exemption or waiver as described above. A person may become eligible to receive an exemption or waiver in a subsequent semester or term if the person completes a semester or term during which the person is not eligible for an exemption or waiver and meets each requirement set out above, as applicable. Education Code 54.2001(a)-(c) |

Policy | Each institution of higher education shall adopt a policy to allow a student who fails to maintain a grade point average as required by this section to receive an exemption or waiver in any semester or term on a showing of hardship or other good cause, including: 1. A showing of a severe illness or other debilitating condition that could affect the student's academic performance; 2. An indication that the student is responsible for the care of a sick, injured, or needy person and that the student's provision of care could affect the student's academic performance; 3. The student's active duty or other service in the United States armed forces or the student's active duty in the Texas National Guard; or 4. Any other cause considered acceptable by the institution. An institution of higher education shall maintain documentation of each exception granted to a student. Education Code 54.2001(d)-(e) |

Conflicts | If a requirement imposed by this section for the continued receipt of a specific exemption or waiver conflicts with another requirement imposed by statute for that exemption or waiver, the stricter requirement prevails. Education Code 54.2001(f) |

Exceptions | This section does not apply to: 1. The waiver provided by Education Code 54.216 or any other reduction in tuition provided to a high school student for enrollment in a dual credit course or other course for which the student may earn joint high school and college credit; 2. The exemption provided by Education Code 54.341(a-2)(1)(A), (B), (C), or (D) or (b)(1)(A), (B), (C), or (D); 3. The exemption provided by Education Code 54.342, 54.366, or 54.367; or 4. Any provision of the Education Code that authorizes or requires the payment of tuition or fees at the rates provided for residents of this state by a person who is not a resident of this state for purposes of Education Code Chapter 54, Subchapter B. Education Code 54.2001(g) |

Tuition Rates | Tuition for a resident student registered in a public junior college is determined by the governing board of each institution, but the tuition may not be less than $8 for each semester credit hour and may not total less than $25 for a semester. Tuition for a nonresident student is determined by the governing board of each institution, but the tuition may not be less than $200 for each semester. Education Code 54.051(n) |

Nonresident Tuition | “Nonresident tuition” means the amount of tuition paid by a person who is not a Texas resident and who is not entitled or permitted to pay resident tuition. Education Code 54.0501(4); 19 TAC 21.22(17) The governing board of a junior college district shall establish the rate of tuition and fees charged to a student who resides outside the district by considering factors such as: 1. The sufficiency of the rate to promote taxpayer equity by encouraging areas benefiting from the educational services of the district to participate in financing the education of students from that area; 2. The extent to which the rate will ensure that the cost to the district of providing educational services to a student who resides outside the district is not financed disproportionately by the taxpayers residing within the district; and 3. The rate that would generate tuition and fees equal to the total amount of tuition and fees charged to a similarly situated student who resides in the district plus an amount per credit hour determined by dividing the total amount of ad valorem taxes imposed by the district in the tax year preceding the year in which the academic year begins by the total number of credit hours for which the students who were residents of the district enrolled in the district in the preceding academic year. The tuition rates for nonresident students that are provided by the applicable provisions of Education Code Chapter 51 and Chapter 54 will be applied to any student who does not demonstrate residency per 19 Administrative Code Chapter 21, Subchapter B, regardless of the student's citizenship. Education Code 54.051(m), 130.0032(d); 19 TAC 13.122(c) |

Liability for Unpaid Nonresident Tuition | If an institution of higher education erroneously classifies a person as a resident of this state and the person is not entitled or permitted to pay resident tuition, the institution of higher education shall charge nonresident tuition to the person beginning with the first academic term that begins after the date the institution discovers the error. Not earlier than the first day of that term, regardless of whether the person is still enrolled at the institution, the institution may request the person to pay the difference between resident and nonresident tuition for an earlier term as permitted by Education Code 54.057. For nonpayment of the amount owed, the institution may impose sanctions only as provided by that section. The institution may not require payment as a condition for any subsequent enrollment by the person in the institution. Regardless of the reason for the error, if an institution of higher education erroneously classifies a person as a nonresident of this state, the institution shall charge resident tuition to the person beginning with the academic term in which the institution discovers the error. The institution immediately shall refund to the person the amount of tuition the person paid in excess of resident tuition. Education Code 54.056 |

Adjusted Rates Excessive Hours | An institution may charge a higher tuition rate, not to exceed the rate charged to nonresident undergraduate students, to a student whose hours can no longer be submitted for formula funding, unless those hours are exempted under 19 Administrative Code 13.104. An institution shall not submit excess hours to the Coordinating Board for the purposes of formula funding, unless those hours are exempt under the provisions of Section 13.104. For the purpose of determining the number of hours required for a degree plan, each institution shall utilize the degree plan designated by the student as of the official census day of the term: 1. For a student who was initially enrolled in the fall of 2023 and in an associate degree program, the excess hours limit is the required semester credit hours for the degree, plus 15; 2. A student initially enrolled in the fall of 2023 but not enrolled in any program is treated as enrolled in a baccalaureate degree program, and the excess hours limit is 150; 3. For an undergraduate resident student initially enrolled in the fall of 2006 or later and in a baccalaureate degree program, the excess hours limit is the hours required for the student's degree, plus 30; 4. For an undergraduate resident student initially enrolled in the fall of 1999 through summer 2006, the excess hours limit is the hours required for the student's degree, plus 45; and 5. For an undergraduate resident student initially enrolled before fall 1999, there is no excess hours limit. An institution shall not consider any hours for which a student has enrolled as part of a master's or professional degree program without first completing a baccalaureate degree in the calculation of the number of hours required for a baccalaureate degree or the equivalent until the student has completed a minimum of 120 hours required for the baccalaureate degree or equivalent. Education Code 54.014(a)-(a-1); 19 TAC 13.103(a)-(b), (d), (a125(b) |

Exceptions | The following are not counted for purposes of determining whether the student has previously earned the number of semester credit hours specified above: 1. Hours earned by an undergraduate student before the award of a prior associate or bachelor’s degree; 2. Hours earned through examination or similar method without registering for a course; 3. Hours from remedial and developmental courses and/or interventions, workforce education courses, or other courses that would not generate credit that could be applied to an academic degree at the institution if the coursework is within limitations specified in 19 Administrative Code 13.107; 4. Hours earned by the student at a private institution or an out-of-state institution; 5. Hours not eligible for formula funding; 6. Semester credit hours earned by the student before graduating from high school and used to satisfy high school graduation requirements; 7. Hours abandoned through enrollment under the Academic Fresh Start Program under Education Code 51.931; and 8. Fifteen semester credit hours not otherwise exempt earned toward a degree program by a student who: a. Has reenrolled at the institution following a break in enrollment from the institution or another institution of higher education covering at least the 24-month period preceding the first class day of the initial semester or other academic term of the student's reenrollment; and b. Successfully completed at least 50 semester credit hours of coursework at an institution of higher education that are not exempt in items 1 to 7 before that break in enrollment. Education Code 54.014(b), 61.0595(d); 19 TAC 13.104,(a125(b) |

Repeated Courses | An institution may charge a higher tuition rate, not to exceed the rate charged to nonresident undergraduate students, to a student who enrolls for the second time in a completed course, even though those hours may be submitted for formula funding, or to a student whose hours may no longer be submitted for formula funding under 19 Administrative Code 13.105. Education Code 54.014(f), 130.0034; 19 TAC 13.126(b) |

Exceptions | The following types of hours are exempt: 1. Hours for remedial and development courses and/or interventions, if the coursework is within the 27-hour limit at two-year colleges and the 18-hour limit at general academic institutions; 2. Hours for special topics and seminar courses; 3. Hours for courses that involve different or more advanced content each time they are taken, including but not limited to, individual music lessons, Workforce Education Courses, Manual Special Topics courses (when the topic changes), theater practicum, music performance, ensembles, certain physical education and kinesiology courses, and studio art; 4. Hours for independent study courses; and 5. Hours for continuing education courses that must be repeated to retain professional certification. An institution shall exempt a student from payment of higher tuition for any course repeated in the final semester or term before graduation, if the course(s) is taken for the purpose of receiving a grade that will satisfy a degree requirement. This exemption applies for only one semester. The exemption does not affect an institution's ability to charge a higher tuition rate for courses that cannot be reported for funding for other reasons such as the excess credit hour limit, or an institution's ability to waive higher tuition rates for economic hardship. 19 TAC 13.106, .108(b), 126(d) |

Policy | If an institution charges a higher tuition rate under 19 Administrative Code 13.126, it shall adopt a policy under which a student is exempted from the payment of that higher tuition rate, if the payment of the higher tuition rate would result in an economic hardship for the student. If an institution charges a higher tuition rate under 19 Administrative Code 13.125, it may adopt a policy under which a student is exempted from the payment of that higher tuition rate if payment of the higher tuition rate would result in an economic hardship for the student. Education Code 54.014(a-2); 19 TAC 13.125(c), 13.126(c) |

Notice | Each institution shall publish information in the catalog about the limitations on hours set out in 19 Administrative Code Chapter 13, Subchapter F, and the tuition rate that will be charged to affected students. Until this material is included in its catalog, the institution shall inform each new undergraduate student enrolling at the institution in writing of the limitations on formula funding and the tuition rate that will be charged to affected students. Each institution of higher education shall track the progress of each student in relation to the excess hours limit, notify the student of the student’s progress toward the limit, and disclose the institution's tuition policy for a student who exceeds the limit. Notification shall occur no later than when a student seeking an associate degree has accumulated 60 hours and when a student seeking a baccalaureate degree has accumulated 120 hours. Education Code 54.014(e); 19 TAC 13.109(b)-(c) |

Reporting | Each institution shall report to the Coordinating Board all information required to comply with the provisions of 19 Administrative Code Chapter 13, Subchapter F. Based upon this information, the Coordinating Board shall maintain a database containing information regarding the number of hours a student has accumulated. 19 TAC 13.109(a) |

Fees Fees for Extraordinary Costs | The governing board of a public junior college may establish a fee for extraordinary costs associated with a specific course or program and may provide that the exemptions provided by Education Code 54.341 do not apply to this fee. Education Code 54.341(g) |

Individualized Courses | Resident students or nonresident students registered for a course or courses in art, architecture, drama, speech, or music, where individual coaching or instruction is the usual method of instruction, shall pay a fee, in addition to the regular tuition, set by the governing board of the institution. Education Code 54.051(l) |

Laboratory Fees | An institution of higher education, including a college district, shall set and collect a laboratory fee in an amount sufficient to cover the general cost of laboratory materials and supplies used by a student. A public junior college may charge a laboratory fee in an amount that does not exceed the lesser of $24 per semester credit hour of laboratory course credit for which the student is enrolled or the cost of actual materials and supplies used by the student. Education Code 54.501(a) |

Aerospace Mechanics Certification Course Fee | The governing board of a public junior college may set and collect a fee per contact hour, not to exceed $4, for each person registered in an aerospace mechanics certification course where the fee is required to offset that portion of the cost of the course, including the cost of equipment and of professional instruction or tutoring, that is not covered by state funding or by laboratory fees. Education Code 54.501(c) |

Use Fees | The governing board of each junior college district shall be authorized to fix and collect rentals, rates, charges, and/or fees, including student union fees and technology fees, from students and others for the occupancy, use, and/or availability of all or any of its property, buildings, structures, activities, operations, or facilities, of any nature, in such amounts and in such manner as may be determined by such board. Education Code 130.123; Dallas County Cmty Coll. Dist. v. Bolton, 185 S.W.3d 868 (Tex. 2005) |

General Deposits | An institution of higher education may collect a reasonable deposit in an amount not to exceed $100 from each student to insure the institution against any losses, damages, and breakage for which the student is responsible and to cover any other amounts owed by the student to the institution. The institution shall return to the student the deposit, less any such amounts owed to the institution by the student. The deposit must be returned within a reasonable period after the date of the student's withdrawal or graduation from the institution, not to exceed 180 days, that provides the institution with sufficient time to identify all amounts owed and to determine that the student does not intend to enroll at the institution in the semester or summer session immediately following the student's withdrawal or graduation or, if the student withdraws or graduates in the spring semester, in the next fall semester. Education Code 54.502(a) |

Student Deposit Fund | The student deposit fund consists of the income from the investment or time deposits of general deposits and of forfeited general deposits. Any general deposit that remains without call for refund for a period of four years from the date of last attendance of the student making the deposit shall be forfeited and become a part of the student deposit fund. Education Code 54.5021 does not prohibit refund of any balance remaining in a general deposit when made on proper demand and within the four-year limitation period. The governing board of the institution may require that no student withdraw the student’s deposit until the student has graduated or has apparently withdrawn from school. The student deposit fund shall be used, at the discretion of the institution’s governing board, for making scholarship awards to needy and deserving students of the institution and making grants under Education Code Chapter 56, Subchapter C, to the students of the institution. The Coordinating Board shall administer the scholarship awards for the institution, including the selection of recipients and the amounts and conditions of the awards. The recipients of the scholarships must be residents of the state as defined for tuition purposes. Not later than August 31 of each fiscal year, each institution of higher education that has an unobligated and unexpended balance in its student deposit fund that exceeds 150 percent of the total deposits to that fund during that year shall remit to the Coordinating Board the amount of that excess. The Coordinating Board shall allocate on an equitable basis amounts received to institutions of higher education that do not have an excess described by this subsection for deposit in their student deposit fund. The amount allocated may be used only for making grants under Education Code Chapter 56, Subchapter M (TEXAS grants). Education Code 54.5021 |

Vehicle Registration/ Parking and Traffic Fees | The governing board of each institution of higher education may charge a reasonable fee for registration of a vehicle under Education Code 51.202. The governing board may fix and collect a reasonable fee or fees for the provision of facilities and the enforcement and administration of parking and traffic regulations approved by the board for an institution; provided, however, that no such fee may be charged to a student, unless the student desires to use the facilities. Education Code 54.505 |

International Education Fee | The governing board of an institution of higher education may charge and collect from students registered at the institution a fee in an amount not less than $1 and not more than $4 for each semester or summer session. The amount of the fee may be increased only if the increase is approved by a majority vote of the students at the institution participating in an election called for that purpose. Fees collected shall be deposited in an international education financial aid fund outside the state treasury. Money in the fund may be used only to assist students participating in international student exchange or study programs. The international education financial aid fund shall be used in accordance with guidelines jointly developed by the student governing body of the institution and the administration of the institution. If an institution does not have a student governing body, the president may appoint a Committee of Students to assist with the development of the guidelines. The fee imposed under this section may not be considered in determining the maximum student services fee that may be charged students enrolled at the institution under Education Code 54.503(b). Education Code 54.5132 |

Continuing Education Course Fees | The governing board of an institution of higher education shall charge a reasonable fee to each person registered in a continuing education course at the institution. The board shall set the fee in an amount sufficient to permit the institution to recover the costs to the institution of providing the course. This section applies only to a course for which the institution does not collect tuition or receive formula funding, including an extension course, correspondence course, or other self-supporting course. Education Code Chapter 54, Subchapters B and D, do not apply to a fee charged under this section, except to a fee for a correspondence course taken by a student who would qualify for an exemption from tuition under Education Code 54.341 if the correspondence course applies towards the student’s degree plan. The governing board of an institution of higher education may grant an exemption provided by Section 54.341 for continuing education courses. Education Code 54.545 |

ROTC Program Fees | The governing board of an institution of higher education may not charge a student enrolled in a Reserve Officers' Training Corps (ROTC) course any amount for the course in excess of the fee as determined by the Coordinating Board under Education Code 51.9112(a). Education Code 51.9112(a) |

Exception | If the governing board of an institution of higher education offers course credit toward a student's degree for a course in which the student enrolls for the purposes of an ROTC program, the Coordinating Board may charge the student tuition for that course as otherwise provided by Education Code Chapter 54 after subtracting any reimbursement or other amount the institution receives from the applicable military service or other source for offering the course. Education Code 51.9112(b) |

Environmental Service Fee | The governing board of an institution of higher education may charge each student enrolled at the institution an environmental service fee, if the fee has been approved by a majority vote of the students enrolled at the institution who participate in a general student election called for that purpose. Education Code 54.5041(a) |

Amount | Unless increased as set out below, the amount of the fee may not exceed: 1. $5 for each regular semester or summer term of more than six weeks; or 2. $2.50 for each summer session of six weeks or less. The amount of the fee may not be increased unless the increase has been approved by a majority vote of the students enrolled at the institution who participate in a general student election called for that purpose. The fee may not be increased if the increase would result in a fee in an amount that exceeds: 1. $10 for each regular semester or summer term of more than six weeks; or 2. $5 for each summer session of six weeks or less. Education Code 54.5041(b), (d) |

Use | The fee may be used only to: 1. Provide environmental improvements at the institution through services related to recycling, energy efficiency and renewable energy, transportation, employment, product purchasing, planning and maintenance, or irrigation; or 2. Provide matching funds for grants to obtain environmental improvements described above. An institution that imposes the environmental service fee may not use the revenue generated by the fee to reduce or replace other money allocated by the college district for environmental projects. Any fee revenue that exceeds the amount necessary to cover current operating expenses for environmental services and any interest generated from that revenue may be used only for purposes provided above. The fee is not considered in determining the maximum amount of student services fees that the institution of higher education may charge. Education Code 54.5041(c), (e)-(g) |

Period of Charge | The fee may not be charged after the fifth academic year in which the fee is first charged unless, before the end of that academic year, the institution has issued bonds payable in whole or in part from the fee, in which event the fee may not be charged after the academic year in which all such bonds, including refunding bonds for those bonds, have been fully paid. Education Code 54.5041(h) |

Student Services Fees | The governing board of an institution of higher education may charge and collect from students registered in the institution fees to cover the cost of student services. The fee or fees may be either voluntary or compulsory as determined by the governing board. The total of all compulsory student fees collected from a student at an institution of higher education for any one semester or summer session shall not exceed $250. No portion of the compulsory fees collected may be expended for parking facilities or services, except as related to providing shuttle bus services. Education Code 54.503(b) |

Student Services | “Student services” means activities that are separate and apart from the regularly scheduled academic functions of the institution and directly involve or benefit students, including textbook rentals, recreational activities, health and hospital services, medical services, intramural and intercollegiate athletics, artists and lecture series, cultural entertainment series, debating and oratorical activities, student publications, student government, the student fee advisory committee, student transportation services other than services under Education Code 54.504, 54.511, 54.512, and 54.513, and any other student activities and services specifically authorized and approved by the governing board of the institution of higher education. The term does not include services for which a fee is charged under another section of the Education Code. Education Code 54.503(a)(1) Whether a particular service falls within the definition of a student services fee is normally a determination to be made in the first instance by the institution's governing board, subject ultimately to judicial review. Atty. Gen. Op. DM-450 (1997) |

Dual Enrollment | If a student registers at more than one institution of higher education within a college or university system under concurrent enrollment provisions of joint or cooperative programs between institutions, the student shall pay all compulsory student services fees to the institution designated as the home institution under the joint or cooperative program. The governing board of the college or university system may waive the payment of all compulsory student services fees at the other institution or institutions. Education Code 54.503(g) |

Incidental Fees | The governing board of an institution of higher education may fix the rate of incidental fees to be paid to an institution under its governance by students and prospective students and may make rules for the collection of the fees and for the distribution of the funds, such funds to be accounted for as other designated funds. The rate of an incidental fee must reasonably reflect the actual cost to the university of the materials or services for which the fee is collected. In fixing the rate, the governing board may consult with a student fee advisory committee, which the governing board may establish if such student committee does not presently exist. The board shall publish in the general catalog of the university a description of the amount of each fee to be charged. Incidental fees include, without limitation, such fees as late registration fees, library fines, microfilming fees, thesis or doctoral manuscript reproduction or filing fees, bad check charges, application processing fees, and laboratory breakage charges, but does not include a fee for which the governing board makes a charge under the authority of any other provision of law. Education Code 54.504 Whether a particular fee falls within the scope of the incidental fees statute is a determination to be made by the institution's governing board in the first instance, subject to review by a court. Atty. Gen. Op. DM-450 (1997) |

Credit Card Fees | An institution of higher education may charge a fee or other amount in connection with a payment of tuition, a fee, or another charge to an institution of higher education that is made or authorized in person, by mail, by telephone call, or through the internet by means of an electronic funds transfer or a credit card, in addition to the amount of the tuition, fee, or other charge being paid, including: 1. A discount, convenience, or service charge for the transaction; or 2. A service charge in connection with a payment transaction that is dishonored or refused for lack of funds or insufficient funds. A fee or other charge under Education Code 54.5011 must be in an amount reasonable and necessary to reimburse the institution for the expense incurred by the institution in processing and handling the payment or payment transaction. Before accepting a payment by credit card, the institution shall notify the student of any fee to be charged. Education Code 54.5011 |

Student Fee Advisory Committee | Before recommending the student fee budget to the governing board of the institution, the president of the institution shall consider the report and recommendations of the student fee advisory committee. Education Code 54.5031(g) |

Membership | Each committee is composed of the following nine members: 1. Five student members who are enrolled for not less than six semester credit hours at the institution and who are representative of all students enrolled at the institution, selected by one of the following methods: a. If the institution has a student government, the student government shall appoint three students to serve two-year terms on the committee and two students to serve one-year terms on the committee. b. If the institution does not have a student government, the students enrolled at the institution shall elect three students to serve two-year terms on the committee and two students to serve one-year terms on the committee. A candidate for a position on the committee must designate whether the position is for a one-year or two-year term. 2. Four members who are representative of the institution, appointed by the president of the institution. Education Code 54.5031(b)-(c) A student member of the committee who withdraws from the institution must resign from the committee. Education Code 54.5031(d) A vacancy in an appointive position on the committee shall be filled for the unexpired portion of the term in the same manner as the original appointment. A vacancy in an elective position on the committee shall be filled for the unexpired portion of the term by appointment by the president of the institution. Education Code 54.5031(e) |

Duties | The committee shall: 1. Study the type, amount, and expenditure of compulsory fees under Education Code 54.503; and 2. Meet with appropriate administrators of the institution, submit a written report on the study, and recommend the type, amount, and expenditure of a compulsory fee to be charged for the next academic year. Education Code 54.5031(f) |

Meetings | A student fee advisory committee shall conduct meetings at which a quorum is present in a manner that is open to the public and in accordance with procedures prescribed by the president of the institution. The procedures prescribed by the president of the institution must: 1. Provide for notice of the date, hour, place, and subject of the meeting at least 72 hours before the meeting is convened; and 2. Require that the notice be: a. Posted on the internet; and b. Published in a student newspaper of the institution, if an issue of the newspaper is published between the time of the internet posting and the time of the meeting. The final recommendations made by a student fee advisory committee must be recorded and made public. Education Code 54.5033 |

Recommendation | If the president’s recommendations to the governing board are substantially different from the committee’s recommendations to the president, the administration of the institution shall notify the committee not later than the last date on which the committee may request an appearance at the board meeting. On request of a member of the committee, the administration of the institution shall provide the member with a written report of the president’s recommendations to the board. Education Code 54.5031(g) |

Course Fee Disclosure | Each institution of higher education, including each college district, shall include in the institution's online course catalog, for each course listed in the catalog, a description and the amount of any special course fee, including an online access fee or lab fee, to be charged specifically for the course. If the institution publishes a paper course catalog, the institution may publish any fees specifically charged for each course using the amounts charged in the most recent academic year. Education Code 54.0051 |

Resident Tuition for Students in Military- Related Programs | A person enrolled at an institution of higher education, including a college district, is entitled to pay tuition and fees at the rates provided for Texas residents if the person is: 1. Enrolled and in good standing in a ROTC program; 2. Enrolled in a corps of cadets, including a corps of cadets at a senior military college; or 3. Enrolled in a corps of midshipmen. Notwithstanding any other law, a person who is entitled to pay resident tuition and fees only as permitted by this section is not considered a Texas resident under Education Code Chapter 54, Subchapter D, for purposes of a financial aid program offered by this state. Education Code 54.224 |

Limitation on Fees Charged Veterans and Their Family Members | An institution of higher education, including a college district, may not impose additional fees, obligations, or burdens concerning payment or registration on a student eligible for state or federal military-related student financial assistance programs for military veterans or their family members that are not otherwise required by those programs to be imposed for the purpose of receiving that assistance. This section does not prohibit an institution of higher education from requiring a student described above to submit a free application for federal student aid (FAFSA). Education Code 56.0065(b), (d) |

Collection | For billing and catalogue purposes, each governing board shall accumulate all the tuition that it charges under Education Code Chapter 54 into one tuition charge. On or before the respective census date for the semester or term, as defined in 19 Administrative Code 13.1, each institution of higher education, including each college district, shall collect in full from each student the amounts set as tuition and mandatory fees established by state law or the respective governing boards, unless: 1. The student's payment due date has been postponed due to pending disbursements of financial aid as described and provided by in Education Code 54.0071; 2. The student's payment due date has been postponed based on the student's election to pay tuition and mandatory fees by installment as provided in Education Code 54.007; or 3. The institution has determined that the student meets the eligibility requirements that allow the student to earn credit at no cost to the student, such as occurs in the Financial Aid for Swift Transfer (FAST) program. Education Code 54.015; 19 TAC 13.123(a) |

Collection Subsequent to the Census Date | An institution of higher education may collect on a due date subsequent to the census date unpaid tuition and mandatory fee balances resulting from an adjustment to a student's enrollment status or an administrative action or unpaid residual balances of tuition and mandatory fees constituting less than five percent of the total amount of tuition and mandatory fees charged to the student by the institution for that semester or term. 19 TAC 13.123(b) |

Formula Funding Requirement | An institution of higher education shall collect from each student who is to be counted for state formula funding appropriations, the tuition and mandatory fees established by state law or by its governing board on or before the end of the 20th class day for each regular semester and the 15th class day for each summer session. An institution of higher education may fulfill this obligation by complying with 19 Administrative Code 13.123(a). An institution may consider a valid contract with the U.S. government for instruction of eligible military personnel, or a valid contract with private business or public service-type organization or institution, such as a hospital, as a collection for the purpose of this section after final payment and adjustment of the amount paid under the contract. 19 TAC 13.123(c) |

Installment Plan | The governing board of each institution of higher education, including each college district, shall provide for the payment of tuition and mandatory fees for a semester or term of 10 weeks or longer through one of the following alternatives: 1. Full payment of tuition and mandatory fees not later than the date established by the institution; or 2. Payment in installments under one or more payment plan options that requires the first payment to be made not later than the date established by the institution. In providing for the payment of tuition and mandatory fees by installment, the institution of higher education must also establish subsequent dates at periodic intervals within the applicable semester or term by which subsequent installment payments are due. For a term of less than 10 weeks, the governing board of each institution of higher education shall provide for the payment of tuition and mandatory fees by requiring full payment of tuition and mandatory fees not later than the date established by the institution, and the governing board may provide for the payment of tuition and mandatory fees by requiring payment in installments under one or more payment plan options that require the first payment to be made not later than the date established by the institution. A date established by an institution of higher education for purposes of making a full payment of tuition and fees or the first installment payment may not be later than the date established by the Coordinating Board for certifying student enrollment for the semester or term for purposes of formula funding. Education Code 54.007(a)-(b-1) |

Unpaid Balances | An institution of higher education may collect on a due date subsequent to a due date for a full payment of tuition and fees or the first installment payment: 1. Unpaid tuition and mandatory fee balances resulting from an adjustment to a student's enrollment status or an administrative action; or 2. Unpaid residual balances of tuition and mandatory fees constituting less than five percent of the total amount of tuition and mandatory fees charged to the student by the institution for that semester or term. Education Code 54.007(b–2) |

Incidental Fee | The governing board of an institution of higher education may assess and collect incidental fees for students utilizing the installment payment option and for students delinquent in payments. The fees must reasonably reflect the cost to the institution of handling those payments. Education Code 54.007(c) |

Failure to Pay Tuition and Fees | A student who fails to make full payment of the required amount of tuition and mandatory fees, including any incidental fees, by the applicable due date may be prohibited from registering for classes until full payment is made. A student who fails to make a full payment prior to the end of the semester or term may be denied credit for the work done that semester or term. The governing board of an institution of higher education may not impose on a student any sanction authorized by Education Code 54.007(d) unless the governing board includes in any written or electronic agreement authorized by the student the following statement printed in boldfaced type or in capital letters: “A STUDENT WHO FAILS TO MAKE FULL PAYMENT OF TUITION AND MANDATORY FEES, INCLUDING ANY INCIDENTAL FEES, BY THE DUE DATE MAY BE PROHIBITED FROM REGISTERING FOR CLASSES UNTIL FULL PAYMENT IS MADE. A STUDENT WHO FAILS TO MAKE FULL PAYMENT PRIOR TO THE END OF THE SEMESTER OR TERM MAY BE DENIED CREDIT FOR THE WORK DONE THAT SEMESTER OR TERM.” The governing board shall notify a student of any delinquent tuition or fee payment as soon as practicable. The institution’s records may be adjusted to reflect the student’s failure to have properly enrolled for that semester or term. Education Code 54.007(d) |

Students on Financial Aid | A student may elect to pay the tuition and mandatory fees of the institution of higher education by installment under this section regardless of whether the student intends to apply a financial aid award administered by the institution toward the tuition and mandatory fees, except that a student whose financial aid award or awards are available to cover the total amount of tuition and mandatory fees may not pay by installment under this section. On receipt of notice of a student’s election to pay tuition and mandatory fees by installment, the governing board of the institution shall apply any financial aid award administered for the student toward the amount of tuition and fees due for that semester or term until the tuition and mandatory fees are paid in full and shall immediately release any remaining amount of the award to the student, except that the institution is not required to apply the award or awards toward the total amount of tuition and mandatory fees in exigent circumstances as determined by the institution. Education Code 54.007(f) |

Agreement Required | The governing board of an institution of higher education shall require a student who elects to pay tuition and mandatory fees by installment under Education Code 54.007 to enter into a written or electronic agreement reflecting the terms and conditions required by this section for the installment plan provided for the student by the governing board. Education Code 54.007(g) |

Payment Options When Financial Aid is Delayed Generally | The governing board of an institution of higher education, including a college district, board of trustees, may postpone the due date for the payment of all or part of the tuition and mandatory fees for a student for a semester or term in which the student will receive one or more delayed financial aid awards if the student has not received the awards by the regular due date for payment of the tuition and mandatory fees and the student agrees to assign to the institution a portion of the awards equal to the amount of tuition and mandatory fees for which the due date is postponed. A postponed due date applies only to the portion of tuition and mandatory fees to be covered by the student's delayed financial aid awards. When the financial aid awards become available, a governing board that postpones a due date under this section shall apply the awards toward the amount of tuition and mandatory fees due and immediately release any remaining amount of the awards to the student. If, after the due date for a student's tuition and mandatory fees is postponed, the student becomes ineligible to receive one or more of the delayed financial aid awards or the amount awarded is less than the amount of tuition and mandatory fees due, the governing board shall provide the student a reasonable period not to exceed 30 days, to pay the unpaid amount of tuition and mandatory fees. The board may deny student credit for hours completed work done in the semester or term if the student fails to pay the tuition and mandatory fees by the end of that period. Education Code 54.0071(a); )-(c) |

Policy | Each institution shall adopt a policy regarding the postponement of a student's payment due date due to pending disbursement of financial aid as described in Education Code 54.0071 and 54.007(f). The institution shall reference its tuition payment policy in any billing statement provided to students regarding the collection of tuition and mandatory fees. 19 TAC 21.4(b13.123(d) |

Students Paying by Installment | If a student with delayed financial aid awards has elected to pay tuition and mandatory fees by installment as permitted by Education Code 54.007 and if the governing board elects to postpone the due ate for the student's tuition and mandatory fees as authorized by this section, the governing board in the manner provided by this section shall postpone the due date for each installment payment that becomes due before the student receives the awards. Education Code 54.0071(e) |

Veterans and Their Family | An institution of higher education, including a community college, must provide for a student eligible for state or federal military-related student financial assistance programs for military veterans or their family members to defer payment of tuition and fees if the receipt of military-related financial assistance awarded to the student is delayed by less than 60 days. The Texas Veterans Commission, in cooperation with institutions of higher education and private or independent institutions of higher education, shall prescribe a standard deferment request form. Education Code 56.0065(c) |

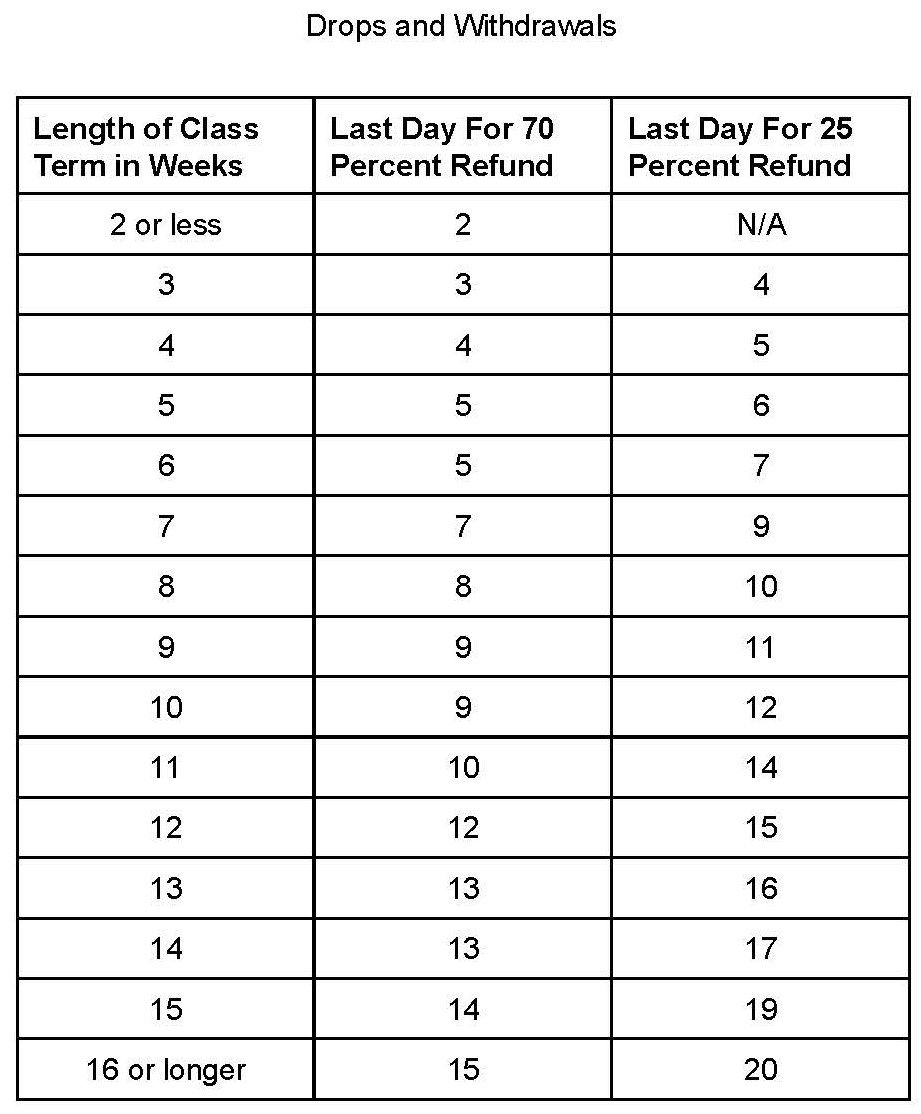

Refunds and Adjustments of Tuition and Fees | A community/junior college, as soon as practicable, shall at a minimum refund mandatory fees and tuition in excess of the minimum tuition collected for courses from which the students drop or withdraw, according to the following schedule. For courses that meet on what the college considers a regular schedule, class days refer to the number of calendar days the institution normally meets for classes, not the days a particular course meets. For courses that meet on an unusual or irregular schedule, the college may exercise professional judgment in defining a class day. The indicated percentages are to be applied to the tuition and mandatory fees collected for each course from which the student is withdrawing. The college may not delay a refund on the grounds that the student may withdraw from the institution or unit later in the semester or term. The institution may assess a nonrefundable $15 matriculation fee if the student withdraws from the institution before the first day of classes. Coordinating Board-approved semester-length courses for which semester credit hours are awarded: 1. A 100 percent refund is to be made for courses dropped prior to the first class day. 2. During the fall or spring semester or comparable trimester: a. During the first 15 class days, 70 percent. b. During the 16th through 20th class days, 25 percent. c. After the 20th class day, none. 3. Six-week summer semester: a. During the first five class days, 70 percent. b. During the sixth and seventh class days, 25 percent. c. After the seventh class day, none. For flex entry and non-semester-length courses with a census date other than the 12th class day (fourth class day for a six-week summer semester): 1. Prior to the first class day, 100 percent. 2. After classes begin (see the table below).  A community/junior or technical college must follow the applicable refund policy outlined above for courses associated with any program that is approved for Title IV federal funding. The institution may determine a refund policy for any other program. Prior to the census date, community and technical colleges may allow hours to be dropped and re-added without penalty to the student if the exchange is an equal one. When the charges for dropped hours are greater than for the hours added, the refund policy outlined above is to be applied to the net charges being dropped. If the charges for hours being added exceed the charges for hours being dropped, the student must pay the net additional charges. Separate withdrawal refund schedules may be established for optional fees such as intercollegiate athletics, cultural entertainment, parking, and yearbooks. A community/junior or technical college shall refund tuition and fees paid by a sponsor, donor, or scholarship to the source rather than directly to the student who has withdrawn if the funds were made available through the institution. 19 TAC 21.5(a)-(e) |

Withdrawal for Military Service | If a student withdraws from an institution of higher education because the student is called to active military service, the institution, at the student’s option, shall refund the tuition and fees paid by the student for the semester in which the student withdraws. [See EGA for grading and credit options] Education Code 54.006(f); 19 TAC 21.5(g) |

Notice of Tuition Set Aside | An institution of higher education, including a college district, that is required by Education Code Chapter 56, Subchapter B, to set aside a portion of a student's tuition payments to provide financial assistance for students enrolled in the institution shall provide to each student of the institution who pays tuition from which a portion is required to be set aside for that purpose a notice that includes: 1. The amount of designated tuition that is set aside for financial aid programs, based on the number of semester credit hours, or equivalent, for which the students originally enrolled; and 2. The generalized formula the institution employs for calculating tuition set-asides. The institution shall provide the notice to the student in a prominently printed statement that appears on or is included with: 1. The student's tuition bill or billing statement, if the institution provides the student with a printed bill or billing statement for the payment of the student's tuition; or 2. The student's tuition receipt, if the institution provides the student with a printed receipt evidencing the payment of the student's tuition. If for any semester or other academic term the institution does not provide the student with a printed tuition bill, tuition billing statement, or tuition receipt, the institution shall include the notice for that semester or other term in a statement prominently displayed in an email sent to the student. The notice may be included in any other email sent to the student in connection with the student's tuition charges for that semester or other term. The institution shall conform to the uniform standards prescribed by the commissioner. Education Code 56.014; 19 TAC 13.127 |

Reporting | Each institution, including each college district, shall report annually to the Coordinating Board the types and amounts of tuition and fees charged to students during the previous academic year. Each institution shall separate these data by semester. [See CDA] 19 TAC 13.143124, .524(d) |

Report of Certain Exemptions | Until September 2013, the governing board of each institution of higher education shall electronically report to the Coordinating Board the information required by Education Code 61.0516 relating to each individual receiving an exemption from fees and charges under Education Code 54.341(a), (a–2), or (b). The institution shall report the information not later than December 31 of each year for the fall semester, May 31 of each year for the spring semester, and September 30 of each year for the summer session. Education Code 54.341(h) |

DATE ISSUED: 10/16/2025

UPDATE 50

FD(LEGAL)-PJC

© 2025 TASB, Inc. All rights reserved. Permission granted to TASB Community College Services subscribers to reproduce for internal use only.